Philippine Stock Exchange

| Philippine Stock Exchange | |

|---|---|

|

|

| Type | Stock exchange |

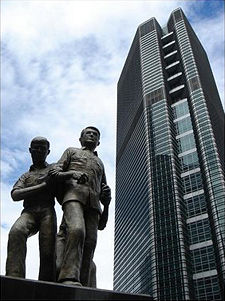

| Location | Makati City, Philippines |

| Owner | The Philippine Stock Exchange, Inc. |

| Key people | Jose C. Vitug, Chairman Francisco Ed. Lim, President and CEO |

| Currency | PHP |

| No. of listings | 244 |

| MarketCap | P7.979 trillion PHP (2007) |

| Volume | P1.338 trillion PHP (2007) |

| Indexes | PSEi |

| Website | www.pse.org.ph |

The Philippine Stock Exchange (Filipino: Pamilihang Sapi ng Pilipinas) (PSE: PSE) is one of the two stock exchanges in the Philippines, the other one being the Philippine Dealing Exchange. It is the primary stock exchange in the Philippines. Aside from being one of the major stock exchanges in Southeast Asia, it is also the first and the longest one operating since 1927.

It currently maintains two trading floors, one in Makati City's Central Business District and one at its headquarters in Pasig City. It is presently composed of a 15-man board, chaired by former Supreme Court Justice Jose Vitug, an independent director, who was reelected a 4th time on May 18, 2008 (since July 2005). Francis Lim was reelected to a 5th term as president since 2004.[1]

The PSE is known for having one of the shortest trading hours of any stock exchange in Asia, only trading from 9:30 am to 12:30 pm PST.[2] A two-hour long afternoon trading session is set to be added to the PSE trading day by June 30, 2009.[3]

Contents |

History

The Philippine Stock Exchange was formed from two stock exchanges, the Manila Stock Exchange (MSE), established on August 8, 1927, and the Makati Stock Exchange (MkSE), which was established on May 27, 1963.

Although both the MSE and the MkSE traded the same stocks of the same companies, the bourses were separate stock exchanges for nearly 30 years until December 23, 1992, when both exchanges merged into the present-day Philippine Stock Exchange.

In June 1998, the Philippine Securities and Exchange Commission granted the PSE a "Self-Regulatory Organization" (SRO) status, meaning the bourse can implement its own policies and establish penalties on erring stock brokers, traders, and companies.

In 2001, one year after the enactment of the Securities Regulation Code, the PSE was transformed from a non-profit, no-stock, member-governed organization into a fledgling revenue-earning corporation headed by a president and a board of directors. The PSE eventually listed its shares on the exchange (traded under the ticker symbol PSE) and eventually ventured on into new fields such as debt securities.

Business

The PSE before the mid-1990s was reminiscent of other outcry stock exchanges found throughout Southeast Asia before the technological advancements made during the last decade. On January 4, 1993, the former Manila Stock Exchange started the computerization of its operations using the Stratus Trading System (STS) with a company called Intelligent Wave Philippines. Later that year, on June 15, the former Makati Stock Exchange adopted the MakTrade trading system, the same system used on the Stock Exchange of Thailand and developed by the Chicago Stock Exchange. Both systems were linked on March 25, 1994, producing one set of opening and closing share prices, but orders were queued up on two different books.

Two years later, on November 13, 1995, both systems were unified when the PSE adopted the "Unified Trading System" (UTS) operating under the MakTrade system.

When the PSE started trading bonds on January 15, 2001, the system was modified to allow stock brokers to trade bonds using the same terminal. Also, the PSE-RoSS Interface System, a system allowing stock brokers to access the Philippine Bureau of the Treasury's Registry of Scriptless Securities (BTr-RoSS), was made operational on the same day.

Companies are listed in the PSE on the First Board, Second Board or the Small and Medium Enterprises Board.

Levels

- Listed companies: 241

- Brokerage houses: 200 +, but only 130 operational

Components

The PSE is split into eight indices based on a company's main source of revenue. They are namely:

- PSE All Shares Index (ALL)

- PSE Composite Index (PSEi)

- PSE Financials Index (FIN)

- PSE Holding Firms Index (HDG)

- PSE Industrial Index (IND)

- PSE Mining and Oil Index (M-O)

- PSE Property Index (PRO)

- PSE Services Index (SVC)

A new classification system went into effect on January 2, 2006, the first trading day of 2006. Some indices, such as the PHISIX, were kept, while others were either merged or dropped.

The PSE was previously split into eight indices (different from the current classification) based on their sector industry classification when companies file their articles of incorporation. They were namely:

- PSE All Shares Index (ALL)

- PSE Commercial/Industrial Index (CI)

- PSE Composite Index (PHISIX)

- PSE Financials Index (BF)

- PSE Mining Index (MIN)

- PSE Oil Index (OIL)

- PSE Property Index (PTY)

- PSE Small and Medium Enterprise Index (SME)

See also

- Economy of the Philippines

- List of East Asian stock exchanges

- List of stock exchanges

External links

References

- ↑ Inquirer.net, Ex-justice reelected PSE chair

- ↑ Market Hours, Philippine Stock Exchange via Wikinvest

- ↑ (UPDATE) PSE to extend trading by two hours in 2009, Philippine Daily Inquirer, August 28, 2008

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||