Petrobras

| Type | Semi-Public (BM&F Bovespa:PETR3/PETR4, NYSE: PBR / PBRA, Latibex:XPBR / XPBRA, Merval APBR) |

|---|---|

| Founded | 1953 |

| Headquarters | |

| Key people | José Sérgio Gabrielli de Azevedo (current President) |

| Industry | Oil and Gasoline |

| Products | Petroleum and derived products BR service stations Lubrax motor oil |

| Market cap | ▲US$ 295.6 Billion (2008) |

| Revenue | ▲US$ 96,3 billion (2008) billion[1] [2] |

| Net income | ▲US$ 12.1 billion[3] USD (2008) |

| Employees | 68.931[4]. (2007) |

| Website | www.petrobras.com |

Petrobras (BM&F Bovespa:PETR3/PETR4, NYSE: PBR / PBRA, Latibex:XPBR / XPBRA, Merval APBR), short for Petróleo Brasileiro S.A., is a semi-public[5] Brazilian energy company headquartered in Rio de Janeiro. The company was founded in 1953 mainly due to the efforts of the Brazilian President Getúlio Vargas. While the company ceased to be Brazil's oil monopoly in 1997, it remains a significant oil producer, with output of more than 2 million barrels of oil equivalent per day, as well as a major distributor of oil products. The company also owns oil refineries and oil tankers. Petrobras is a world leader in development of advanced technology from deep-water and ultra-deep water oil production.

Contents |

Overview

Petrobras controls significant oil and energy assets, as well as related business activities, outside Brazil in 18 nations in Africa, North America, South America, Europe and Asia. These holdings as well as its activities in Brazil give it total assets of $133.5 billion. The Brazilian government owns 55.7% of Petrobras' common shares (with voting rights),[6] however, privately held portions are traded on BM&F Bovespa, where it is part of the Ibovespa index.

Petrobras also has oil shale processing activities started in 1953 by developing Petrosix technology for extracting oil from oil shale. The pilot plant started in 1982 and the commercial production started in 1992. At present, the company operates 2 retorts, the largest of which processes 260 tonnes/hour of oil shale.

Petrobras operated the world's largest oil platform - the Petrobras 36 Oil Platform - until an explosion on 15 March 2001 led to its sinking on 20 March 2001.

Petrobras is also recognized for being the largest sponsor of arts, culture, and the environment in Brazil through several projects. Among the environmental initiatives, Petrobras is the main supporter of whale conservation and research through the Brazilian Right Whale Project [7] and the Instituto Baleia Jubarte (Brazilian Humpback Whale Institute).[8] Petrobras is a long-term sponsor of the Williams Formula-1 team. The company employs the H-Bio process to produce biodiesel.[9]

As of 19 May 2008, Petrobras is the 3rd largest company of the Americas, after Exxon Mobil and General Electric making it larger than Microsoft, AT&T, and Wal-Mart, and the 6th largest in world. [10]

History

Petrobras was created in 1953 during the government of Brazilian president Getúlio Vargas, with great popular support under the motto "The Petroleum is Ours!". The company's creation provoked the wrath of the Brazil's elite, which reacted fervently against the institution and Vargas himself, who committed suicide in 1954. Many attempts were made to privatize the company, especially during Brazil's dictatorship period (1969-1974).

Chronology

- 1953: the company is created by president Getúlio Vargas;

- 1954-1961: period of great instability in the company's politics, caused by the great government opposition against it;

- 1961: a report released by the government revealed pessimist news about oil perspective in the country's terrains;

- 1973: after a short growth, the company is heavily affected by the first oil crisis, which stopped the period known as "Brazilian Miracle", a period of great growth in the country's economy. The company, weakened, almost bankrupted;

- 1974: Petrobras discovered a huge oil field in Bacia de Campos, which the oil reserves raised the company's finances, "resurrecting" its operations nationwide;

- 1975: the company signed "risk contracts" of partnership with private oil companies to intensify the search for new oil fields and to consolidate the its influences in the country;

- 1979: it was the second oil crisis. Petrobras was affected, but not with the same strong effects as in the crisis of 1973;

- 1997: the government sanctions the Law N. 9.478, "breaking" the company's commercial monopoly in Brazil and allowing its competitors to act in the country's oil fields. In this same year, Petrobras reached the mark of one-million barrels per day production. The company begins its operations out of Brazilian domains, starting agreements with the Latin-American governments;

- 2000: the company reaches the world record of oil exploration in deep waters (1,877 meters below sea-level);

- 2001: disaster with the P-36 Platform, that was the world's biggest platform for oil exploration. The platform, by technical failures, sank on 20 May with an estimated weight of 1500 tons of oil;

- 2003: acquires the Argentina's largest oil company Perez Companc Energía (PECOM Energía S.A.) and its operational bases in Bolivia, Peru and Paraguay;

- 2006: Petrobras reaches the Brazilian auto-sufficiency in oil needs;

- 2007: it was the company's best performance in its entire history, with more than US$13 billion of profit. The company announced the discovery of the giant oil field "Jupiter", in Santos. Petrobras stock market's value increases about 106% (from February to December);

- 2008: discovery of what can be the world's third largest oil field. More details of the discovery, however, are still unverified.

Bolivian Controversy

On May 2006, Bolivia's president Evo Morales announced the nationalization of all gas and oil fields in the country. In a political discourse, trying to justify this act, he said: (translated from Portuguese)

Evo Morales ordered the occupation of all fields by the Bolivian Army. Petrobras was heavily affected by the nationalization. At the time, the company's Bolivian subsidiary had great importance in the country's economy[11]:

- Petrobras represented 24% of the Bolivian industrial taxes, 18% of the country's GDP and 20% of the foreign investments;

- The company operated in 46% of the oil reserves in Bolivia and was responsible for 75% of the country's gas exports to Brazil;

- The company invested, between 1994 and 2005, US$1,5 billion in the Bolivian economy.

The dipomatic relationship between Petrobras and the Bolivian government was affected. After a long period of negotiation, on October 28, 2006, Petrobras signed a deal, which stated that the company would stay with 18% of the gas and oil exploration's profit. The Bolivian government would stay with 82% of this profit.[12]

Business[13]

Petrobras' most important business keys are its oil reserves in Brazil (the company's main oil field nowadays is the Campos Basin, which represents over 80% of the Brazilian oil production). The so called "green energy" is gaining considerable importance in the company's business, which was very well-succeeded with the biodiesel fuel. Petrobras recently opened its business to the ethanol fuel, facing great competition against the North American ethanol. However, based on infrastructure investments, the biofuels will represent only 1% of the company's profit between 2008 and 2012.[14]

Petrobras makes money, in general, with the following markets:

- Domestic Sales: it represents the majority of the company's profit and includes the extraction and distribution of oil, natural gas, electricity and petrochemical products;

- Export Sales: the company's main exports are not related to oil extraction itself, but with mechanic technologies. However, it is planned to the company exports oil in large quantities when it begins to explore the Jupiter and the Tupi fields (see "List of recent oil field discoveries");

- Foreign Exchange Gains: the company imports natural gas from other South American countries (mostly from Bolivia). According to the Brazilian group National Petroleum Agency, Petrobras owns Brazil's largest and most important gas pipe network, having a near monopoly of the natural gas marketed in the country.

Petrobras works extensively with foreign acquisitions too, buying and controlling the most important energy companies in South America and exploring huge deep-water fields of West Africa and the Gulf of Mexico. Petrobras is known for its leadership in deep-water exploration: the Tupi field itself, that is said to be the world's third largest oil field (information that is still unverified), is a deep-water discovery, located in the pre-salt layer.

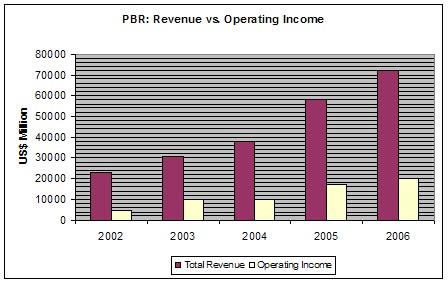

In short, the company begun to increase its profit from 2002, with the government's heavy investments on it. In the first quarter of 2008, Petrobras reached US$295.6 billion of market value, surpassing Microsoft (US$274 billion) and becoming America's third largest company, ahead of giant oil companies such as BP and Chevron-Texaco, and only behind of ExxonMobil and General Electric. Petrobras' market value is also bigger than Industrial and Commercial Bank of China (US$289.3 billion), making it the sixth biggest company in market value in the world.

Competition

Comparison with world-wide companies

| Company | Reserves (MM boe) | Current Years of Production | Oil & Gas Production (1000s boe/d) 2006 | Oil & Gas Production Growth (%) 2006 |

| Petrobras | 11,458 | 14.2 | 2,287 | 4.5 |

| BP | 17,368 | 10.4 | 3,926 | -1.9 |

| ChevronTexaco | 11,020 | 10.9 | 2,667 | 6.1 |

| ExxonMobil | 21,518 | 11.3 | 4,238 | 3.8 |

| Royal Dutch Shell | 11,108 | 6.7 | 3,474 | -1.0 |

Growth

- Rising prices: the company profits with the oil rising prices, caused by the great political instability in Middle East, a major oil producer region. The oil price reached US$120 on 20 May 2008;

- Increasing demand: the oil demand has increased drastically in the emergent countries, for which Petrobras exports its technologies. The BRIC countries' (Brazil itself, Russia, India and China) growth explains this huge demand. The Brazilian auto-sufficiency in Petroleum (May 2006) allowed the company to export small quantities of oil too;

- Political issues: despite of being half-controlled by private investments, the company's stock shares majority belongs to the Brazilian government, what gives it the right to control the company's finances and operations. The recent growth of the company is explained by the political stability. Since 1997 the Brazilian oil market was opened to foreign investments, but Petrobras continues to be the largest oil company in the country, enjoying an almost monopoly condition;

General Oil Reserves Situation

During a presentation made at the 20th National Forum, it was revealed that Petrobras has the 4th biggest oil reserves among petrochemical companies with shares in trading markets, with 11.7 billion barrels of oil (this information does not include the recent discoveries of the mega-fields of Tupi, Jupiter, Carioca and Bem-te-vi).[15]

Profitability

From May 1997 to June 2006, the company's value in the Ibovespa increased about 1200%, reaching a record profit in 2006, with approximately R$25.9 billion becoming the most profitable public company in Latin America of 2006. The discovery of large reserves in Santos increased its stock price by about 19% in one day. Petrobras, is considered the most reliable Blue Chip of the Bovespa Stock Exchange. While the North American Crisis of 2007 decreased the value of the stocks of a great majority of stock markets in the world, Petrobras, helped hold the Bovespa's activities steady, making it one of the least affected stock exchanges in the world by the crisis.

Investment Grade

On April 30, 2008, Brazil received an "investment grade" rating from Standard & Poor's, given to countries with stable and consistent growing economy. According to Standard & Poor's, Brazil jumped from a BB+ grade to a BBB-, the minimum level any country needs to reach to receive the grade. Petrobras had great importance in the grade, since its performance played a big part in the country's growth. It is expected that the grade will be of great importance to the company's international operations, attracting foreign investments.

Investors criticized the company for increasing the gasoline prices in Brazil, despite the record oil production. The company is having problems adapting its business to the ethanol's market as well.

Devaluation

After a great advance on its stock shares (reaching R$52.30 in Ibovespa) in May 2008, Petrobras faced a great devaluation in the following month, with its shares decreasing to R$43.90 in June 19, 2008[16]. The most probable explanation about the great fall was the lack of information about the mega-fields recently discovered by the company. The great instability in Wall Street's markets also had great weight in those terrible results.[17]

Petrobras' fall also guided the bad results on the entire BM&F Bovespa: as Petrobras and Vale responds for more than 25% of BM&F Bovespa's trade value[18], the devaluation of those companies' shares led it to lose more than 6,000 points in just 25 days.

However, with the continuous decrease of the oil prices, Petrobras' stock shares fell to R$33,00 on August 14, 2008. Its market cap presented the biggest devaluation of Americas, with a loss of US$93 billion (August 13, 2008).

Significant milestones in company history

- On December 19, 2005, Petrobras announced a contract with the Japanese Nippon Alcohol Hanbai for the creation of a joint-venture based in Japan to import ethanol from Brazil, to be called Brazil-Japan Ethanol. A primary target of the company is the development of an ethanol market in Japan.

- On April 21, 2006, President Luiz Inácio Lula da Silva announced Brazil's self-sufficiency in petroleum on board the Petrobras P-50 Oil Rig, a Floating Production Storage and Offloading vessel.

- In November 2007, Petrobras made a major new oil field discovery off the coast of Rio de Janeiro. The Tupi oil field, in the Santos Basin, is estimated to have a volume of approximately 5 billion to 8 billion barrels. Should these estimates prove to be correct, Tupi would be the world's largest new oil source since Kashagan in Kazakhstan in 2000. This would raise the country’s reserves by 62 per cent and put Tupi on par with Norway’s 8.5bn barrels of proven oil reserves.[19]

- The Financial Times listed Petrobras as one of the world's 50 largest companies in 2007.[20]

- On January 21, 2008, Petrobras announced the discovery of Jupiter, a huge oil field which could equal the Tupi oil field. It is located 37 km (23 mi) from Tupi, 5,100 m (16,730 ft) below the Atlantic Ocean, 290 km (180 mi) from Rio de Janeiro.[21]

- On April 14, 2008, a second massive oil field was announced in the same region as the Tupi oil field with reserves estimated at 33 billion barrels of oil.[22]

- On May 21, 2008, Petrobras announced the discovery of a third megafield, located on the coast of the State of São Paulo.

List of recent oil field discoveries

From 2002-2005, Petrobras doubled its success rate at drilling new wells.[23]

| Date | Basin | Field | API gravity |

| April 18, 2006 | Espirito Santo | Golfinho | 40 |

| June 11, 2006 | Santos | 1-RJS-628A | 30 |

| March 2, 2007 | Campos | Caxareu | 30 |

| March 29, 2007 | Santos | below the salt layer | 30 |

| June 8, 2007 | Espirito Santo | Pirambu | 29 |

| September 4, 2007 | Santos | Tupi | 27 |

| September 10, 2007 | Campos | Xerelete | 18 |

| September 20, 2007 | Santos | Tupi | 28 |

| October 11, 2007 | Sergipe | Piranema | 44 |

| January 21, 2008 | Santos | Jupiter |

Mega-fields

The company's most important discoveries started at the end of 2007, when the first mega-field, named Tupi, was found at a depth of 5,000 meters below the sea level, the first discovery of the company in the pre-salt layer. The second discovery was announced on January 21, 2008: the new mega-field was named Jupiter and had the same size as Tupi.[24]. The company revealed no more information about the field, forcing many investors to regard those facts as an "industrial secret".

On May 21, 2008, the company announced the discovery of a third oil megafield[25], located 250Km distant from the state of São Paulo, at a depth between 6000 and 6300 meters below sea level. The discovery was made by a consortium formed by Petrobras (66% of participation), Shell (20%) and Galp Energia (14%). The field's oil reserves had an API gravity between 25 and 28.

Criticisms

According to the Brazilian economy website InfoMoney.com, the North American Stock Companies are considering the oil mega-fields' discoveries suspicious. On May 24, 2008, the company' shares fell 4% because of the scarce information given by Petrobras about the fields.[26] (Portuguese)

An article written by Roberto Altenhofen Pires Pereira for InfoMoney.com said (translated from Portuguese):

Reputation

By the end of 2003, Petrobras subscribed to the United Nations Global Compact, a voluntary agreement which encompasses a set of principles regarding human rights, working conditions and the environment.

The company's growth since 2006 has made Petrobras the most profitable company in Brazilian economy, and gave it great importance worldwide, being recognized as the eighth biggest oil exploring company in the world.[27]

Since 2006 Petrobras has been listed in the Dow Jones Sustainability Index, an important reference index for environmentally and socially responsible investors.

On February 25, 2008, the Spanish consultancy firm Management and Excellence acknowledged Petrobras as the world's most sustainable oil company.[28]

The civil society named Transparency International, which fights against global corruption, published a list on April 28, 2008 containing the names of 42 companies with high transparency levels, in which Petrobras was included.[29]

The World Trademark Review society has rated Petrobras as the South America's brand management leader, competing with Coca-Cola, Pepsico, and Procter and Gamble. [30]

Global Operations

Petrobras global operations extends over 27 countries (including Brazil). Those operations are more related to diplomatic trades than oil exploration, although the company has important fields in India, Turkey, Angola and Nigeria. The most important countries for commercial agreements are Japan, United Kingdom and China. The complete map can be seen in Petrobras official link Petrobras Worldwide.

Petrobras is a member of the following international associations:

- ARPEL (Asociación Regional de Empresas de Petroleo y Gas Natural en Latinoamérica y el Caribe)

- IPIECA (International Petroleum Industry Environmental Conservation Association)

- OGP (International Association of Oil and Gas Producers)

- WBCSD (World Business Council for Sustainable Development)

Petrobras World Offices

|

|

Petrobras in Popular Culture

- Many Brazilian films and TV shows sponsored by Petrobras contain shots of the enterprise's activities.

- In the Speed Racer live-action movie, one of the cars featured is the "Green Energy", a biodiesel fueled racing car sponsored by Petrobras.

See also

- History of Brazil (1945-1964)

- Ethanol fuel in Brazil

- Petrobras 36 Oil Platform

- Petrosix

- Transpetro

- Tupi oil field

References

- ↑ Economia

- ↑ [1]

- ↑ Petrobrás Profit breaks record in 2nd Quarter 2008

- ↑ Conheça a Petrobras,

- ↑ Petrobras - Investor Relations

- ↑ Source: 09-July-2006 - Petrobras Investor Relation Site

- ↑ Brazilian Right Whale Project

- ↑ Instituto Baleia Jubarte

- ↑ Petrobras.com

- ↑ Petrobras ultrapassa valor de mercado da Microsoft e soma US$ 287 bi - Portal EXAME

- ↑ Saiba o tamanho da Petrobras na economia da Bolívia, e a importância da Bolívia para a Petrobras - 02/05/2006 - EFE - Economia

- ↑ Folha Online - Dinheiro - Acordo com Bolívia garante rentabilidade para Petrobras, diz Silas - 29/10/2006

- ↑ http://www2.petrobras.com.br/ri/spic/bco_arq/2778_form_20f_2005_port_16ago_alt8dez06.pdf

- ↑ Microsoft PowerPoint - Petrobras and Biofuels - May 2007.ppt

- ↑ Petrobras.com

- ↑ [2]

- ↑ InfoMoney: Petrobras: perda de suporte pode levar ações preferenciais aos R$ 43,00

- ↑ InfoMoney: JPMorgan Chase rebaixa recomendação do Brasil para underweight

- ↑ "Petróleo mostra que 'Deus pode mesmo ser brasileiro'". BBC Brasil (2007-11-16). Retrieved on 2008-05-26.

- ↑ "Global 500 2007 accounts" (pdf). Financial Times (2007-07-29). Retrieved on 2008-05-26.

- ↑ Duffy, G (2008-01-22). "'Huge' oil field found off Brazil". BBC News. Retrieved on 2008-05-26.

- ↑ "Brazil Finds New Huge Oilfield, Possibly World's Third Largest". Brazzil Mag (2008-04-14). Retrieved on 2008-05-26.

- ↑ Petrobras 2006 20-f, item 4, p 26 via Wikinvest

- ↑ Press Release: Important Gas and Condensate field discovered in the Pre-Salt layer

- ↑ New Oil Accumulation Discovered in the Santos Basin Pre-Salt Layer

- ↑ InfoMoney: Reação às descobertas da Petrobras é posta em xeque, e compromete rumo da ação

- ↑ Portuguese: Petrobras Press release (2007-01-30). "Petrobras é 8ª empresa de petróleo com ações em bolsa". Petrobras. Retrieved on 2008-05-26.; "English".

- ↑ Management And Excellence

- ↑ "Petrobras is a "transparency reference" in the oil sector" (2008-04-29). Retrieved on 2008-05-29.

- ↑ Petrobras.com

- ↑ Untitled Document

External links

- Global official web site (English)

- Brazilian official web site (Portuguese)

- Petrobras' News Agency (English)

- Petrobras Magazine (English)

|

|||||