Monopoly

In economics, a monopoly (from Greek monos , alone or single + polein , to sell) exists when a specific individual or enterprise has sufficient control over a particular product or service to determine significantly the terms on which other individuals shall have access to it.[1] Monopolies are thus characterized by a lack of economic competition for the good or service that they provide and a lack of viable substitute goods.[2] The verb "monopolize" refers to the process by which a firm gains persistently greater market share than what is expected under perfect competition.

A monopoly should be distinguished from monopsony, in which there is only one buyer of a product or service; a monopoly may also have monopsony control of a sector of a market. Likewise, a monopoly should be distinguished from a cartel (a form of oligopoly), in which several providers act together to coordinate services, prices or sale of goods.

A government-granted monopoly or legal monopoly is sanctioned by the state, often to provide an incentive to invest in a risky venture or enrich a domestic constituency. The government may also reserve the venture for itself, thus forming a government monopoly.

The term "monopoly" first appears in Aristotle's Politics, wherein Aristotle describes Thales of Miletus' cornering of the market in olive presses as a monopoly[3] (μονοπωλίαν)[4].

Contents |

Historical monopolies

Common salt (sodium chloride) historically gave rise to natural monopolies. Until recently, a combination of strong sunshine and low humidity or an extension of peat marshes was necessary for winning salt from the sea, the most plentiful source. Changing sea levels periodically caused salt "famines" and communities were forced to depend upon those who controlled the scarce inland mines and salt springs, which were often in hostile areas (the Dead Sea, the Sahara desert) requiring well-organized security for transport, storage, and distribution. The "Gabelle", a notoriously high tax levied upon salt, played a role in the start of the French Revolution, when strict legal controls were in place over who was allowed to sell and distribute salt.

The "natural monopoly" problem

A natural monopoly is defined as a theoretical situation in which production is characterized by falling long-run marginal cost throughout the relevant output range. In such situations kernel, a policy of laissez-faire must result in a single seller. The conventional Paretian solution to market failure of this kind is public relations (in the United States) or public enterprise (in the United Kingdom).

Monopoly through integration

A monopoly may be created through vertical integration or horizontal integration. The situation in which a company takes over another in the same business, thus eliminating a competitor (competition) describes a horizontal monopoly. While a vertical monopoly involves the takeover of upstream suppliers and/or downstream buyers..

Economic analysis

- No close substitutes: A monopoly is not merely the state of having control over a product; it also means that there is no real alternative to the monopolised product.

- A price maker: Because a single firm controls the total supply in a pure monopoly, it is able to exert a significant degree of control over the price by changing the quantity supplied.

Other common assumptions in modeling monopolies include the presence of multiple buyers (if a firm is the only buyer, it also has a monopsony), an identical price for all buyers, and asymmetric information.

A company with a monopoly does not undergo price pressure from competitors, although it may face pricing pressure from potential competition. If a company raises prices too high, then others may enter the market if they are able to provide the same good, or a substitute, at a lower price.[5] The idea that monopolies in markets with easy entry need not be regulated against is known as the "revolution in monopoly theory".[6]

A monopolist can extract only one premium, and getting into complementary markets does not pay. That is, the total profits a monopolist could earn if it sought to leverage its monopoly in one market by monopolizing a complementary market are equal to the extra profits it could earn anyway by charging more for the monopoly product itself.

However, the one monopoly profit theorem does not hold true if there exist:

- Stranded customers in the monopoly good.

- Poorly informed customers.

- High fixed costs in the tied good.

- Economies of scale in the tied good.

- Price regulations for the monopoly product

Price setting for unregulated monopolies

In economics, a firm facing the entire market demand curve is said to have monopoly power. This is in contrast to a price-taking firm, which operates in a negligible segment of the overall market and thus faces a demand curve with infinite price elasticity. The pricing and production choices made by these firms follow identical decision rules. That is, regardless of the type of firm, the profit maximizing price and quantity choice will equate the marginal cost and marginal revenue of production (see diagram). The key difference is in the outcome of such a rule: typically a monopoly selects a higher price and lower quantity than a price-taking firm.

There are important points for one to remember when considering the monopoly model diagram (and its associated conclusions) displayed here. The result that monopoly prices are higher, and production output lower, than a competitive firm follow from a requirement that the monopoly not charge different prices for different customers. That is, the monopoly is restricted from engaging in price discrimination. If the monopoly were permitted to charge individualized prices, the quantity produced, and the price charged to the marginal customer, would be identical to a competitive firm, thus eliminating the deadweight loss.

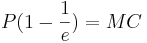

As long as the price elasticity of demand for most customers is less than one in absolute value, it is advantageous for a firm to increase its prices: it then receives more money for fewer goods. With a price increase, price elasticity tends to rise, and in the optimum case above it will be greater than one for most customers. The following formula gives the relation among price, marginal cost of production and demand elasticity that maximizes a monopoly profit:  where (e) is the elasticity of demand. A monopoly's power is given by the vertical distance between the point at which the marginal cost curve (MC) intersects with the marginal revenue curve (MR) and the demand curve. The longer the vertical distance, (i.e., the more inelastic the demand curve) the greater the monopoly's power, and thus, the larger its profits.

where (e) is the elasticity of demand. A monopoly's power is given by the vertical distance between the point at which the marginal cost curve (MC) intersects with the marginal revenue curve (MR) and the demand curve. The longer the vertical distance, (i.e., the more inelastic the demand curve) the greater the monopoly's power, and thus, the larger its profits.

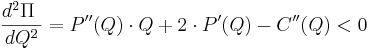

Calculating monopoly output

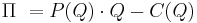

The single price monopoly profit maximization problem is as follows:

The monopoly profit is its total revenue minus its total cost. Let the price it sets as a market response be a function of the quantity it produces (Q)  and let its cost function be as a function of quantity

and let its cost function be as a function of quantity  . The monopoly's revenue is the product of the price and the quantity it produces. Hence its profit is:

. The monopoly's revenue is the product of the price and the quantity it produces. Hence its profit is:

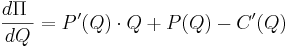

Taking the first order derivative with respect to quantity yields:

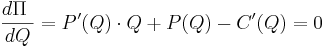

Setting this equal to zero for maximization:

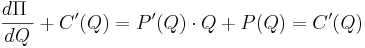

i.e. marginal revenue = marginal cost, provided

(the rate of marginal revenue is less than the rate of marginal cost, for maximization).

This procedure assumes that the monopolist knows the exact demand function.[7]

Monopoly and efficiency

According to standard economic theory (see analysis above), a monopoly will sell a lower quantity of goods at a higher price than firms would in a purely competitive market. The monopoly will secure monopoly profits by appropriating some or all security of the stop consumer surplus. Since the loss in consumer surplus is higher than the monopolist's gain, this creates deadweight loss, which is inefficient and a form of market failure.

Negative aspects

It is often argued that monopolies tend to become less efficient and innovative over time, becoming "complacent giants", because they do not have to be efficient or innovative to compete in the marketplace. Sometimes this very loss of psychological efficiency can raise a potential competitor's value enough to overcome market entry barriers, or provide incentive for research and investment into new alternatives. The theory of contestable markets argues that in some circumstances (private) monopolies are forced to behave as if there were competition because of the risk of losing their monopoly to new entrants. This is likely to happen where a market's barriers to entry are virtualy low. It might also be because of the availability in the longer term of substitutes in other markets. For example, a canal monopoly, while worth a great deal in the late eighteenth century United Kingdom,was worth much less in the late nineteenth century because of the introduction of railways as a substitute.

Positive aspects

Some argue that it can be good to allow a firm to attempt to monopolize a market, since practices such as dumping can benefit consumers in the short term; and once the firm grows too big, it can be dealt with via regulation. When monopolies are not broken through the open market, often a government will step in, either to regulate the monopoly, turn it into a publicly owned monopoly environment, or forcibly break it up (see Antitrust law). Public utilities, often being natural filiations and less susceptible to efficient breakup, are often strongly regulated or publicly owned. AT&T and Standard Oil are debatable examples of the breakup of a private monopoly. When AT&T was broken up into the "Baby Bell" components, MCI, Sprint, and other companies were able to compete effectively in the long distance phone market and began to take phone traffic from the less efficient AT&T server.

Hotelling's law

Mathematician Harold Hotelling came up with Hotelling's law which showed that cases exist, where offensive monopoly has advantages for the consumer. If there is a beach where customers are distributed evenly along it, an entrepreneur setting up an ice cream stand would naturally place it in the middle of the beach. A competing ice cream seller would do best to place his competing ice cream stand next to it to gain half of the market share, but two stalls right next to each other is not an ideal situation for the people on the beach, with claims. A monopolist who owns both stalls on the other hand, would distribute his ice cream stalls some distance apart.[8]

Examples of alleged and legal monopolies

- The salt commission, a legal monopoly in China formed in 758.

- British East India Company; created as a legal trading monopoly in 1600.

- Dutch East India Company; created as a legal trading monopoly in 1602.

- U.S. Steel; anti-trust prosecution failed in 1911.

- Standard Oil; broken up in 1911.

- National Football League; survived anti-trust lawsuit in the 1960s, convicted of being an illegal monopoly in the 1980s.

- Major League Baseball; survived U.S. anti-trust litigation in 1922, though its special status is still in dispute as of 2008.

- United Aircraft and Transport Corporation; aircraft manufacturer holding company forced to divest itself of airlines in 1934.

- American Telephone & Telegraph; telecommunications giant broken up in 1982.

- Microsoft; settled anti-trust litigation in the U.S. in 2001; fined by the European Commission in 2004, which was upheld for the most part by the Court of First Instance of the European Communities in 2007. The fine was 1.35 Billion USD in 2008 for incompliance with the 2004 rule.[9][10]

- De Beers; settled charges of price fixing in the diamond trade in the 2000s.

- Joint Commission; has a monopoly over whether or not US hospitals are able to participate in the Medicare and Medicaid programs.

- Telecom New Zealand; local loop unbundling enforced by central government.

- Deutsche Telekom; former state monopoly, still partially state owned, currently monopolizes high-speed VDSL broadband network.[11]

- Monsanto has been sued by competitors for anti-trust and monopolistic practices. They hold between 70% and 100% of the commercial seed market.

- AAFES has a monopoly on retail sales at overseas military installations.

- New York Yankees bought every free agent on the 2008 MLB free agent market.

See also

Market forms

- Monopolistic competition

- Complementary monopoly

- Duopoly

- Monopsony

- Bilateral monopoly

- Oligopoly

Types

- Cartel

- Natural monopoly

- Monopolies of knowledge

Proposed benefits

- The Long Tail

- Economies of scale

Monopolistic practices

- Dumping

- Predatory pricing

- Price discrimination

- Zone pricing

- Cornering the market

Simulation of Monopoly Market

- Beat The Market

- Monopoly (game)

General

- Creative destruction

- Free market

- List of economics topics

- Monopoly law

- Monopsony

- Perfect competition

- Competition regulator

Notes and references

- ↑ Milton Friedman (2002). "VIII: Monopoly and the Social Responsibility of Business and Labor" (in English) (paperback). Capitalism and Freedom (40th anniversary edition ed.). The University of Chicago Press. pp. 208. ISBN 0-226-26421-1.

- ↑ Blinder, Alan S; William J Baumol and Colton L Gale (June 2001). "11: Monopoly" (in English) (paperback). Microeconomics: Principles and Policy. Thomson South-Western. pp. 212. ISBN 0-324-22115-0. "A pure monopoly is an industry in which there is only one supplier of a product for which there are no close substitutes and in which is very difficult or impossible for another firm to coexist".

- ↑ http://www.constitution.org/ari/polit_01.htm

- ↑ http://www.perseus.tufts.edu/cgi-bin/ptext?doc=Perseus%3Atext%3A1999.01.0057&layout=&loc=1.1259a

- ↑ Depken, Craig (November 23, 2005). "10". Microeconomics Demystified. McGraw Hill. pp. 170. ISBN 0071459111.

- ↑ The revolution in monopoly theory, by Glyn Davies and John Davies. Lloyds Bank Review, July 1984, no. 153, p. 38-52.

- ↑ For a discussion on a monopolist who does not know the demand function, see [1] where a free software is available as well.

- ↑ Hotelling's Law Economyprofessor.com

- ↑ Leo Cendrowicz. "Microsoft Gets Mother Of All EU Fines". Forbes. Retrieved on 2008-03-10.

- ↑ "EU fines Microsoft record $1.3 billion". Time Warner. Retrieved on 2008-03-10.

- ↑ Kevin J. O'Brien, Regulators in Europe fight for independence, International Herald Tribune, November 9, 2008, Accessed November 14, 2008.

Further reading

- Guy Ankerl, Beyond Monopoly Capitalism and Monopoly Socialism. Cambridge,Mass.: Schenkman Pbl., 1978. ISBN0870739387

- Impact of Antitrust Laws on American Professional Team Sports

External links

- Monopoly: A Brief Introduction by The Linux Information Project

- Monopoly by Elmer G. Wiens: Online Interactive Models of Monopoly (Public or Private) and Oligopoly

- Monopoly Profit and Loss by Fiona Maclachlan and Monopoly and Natural Monopoly by Seth J. Chandler, Wolfram Demonstrations Project.

Criticism

- Natural Monopoly and Its Regulation

- The Myth of the Natural Monopoly

- Natural Monopoly and Its Regulation

- From rulers' monopolies to users' choices A critical survey of monopolistic practices