Minimum wage

A minimum wage is the lowest hourly, daily, or monthly wage that employers may legally pay to employees or workers. Equivalently, it is the lowest wage at which workers may sell their labor. First enacted in Australia and New Zealand in the late nineteenth century,[1] minimum wage laws are now enforced in more than 90% of all countries.[2]

In one survey conducted for the Employment Policies Institute, almost three-quarters (73%) of labor economists believed that an increase in the minimum wage increases unemployment. Most of them believed that the Earned Income Tax Credit was a more effective tool to assist low-income workers.[3] Both supporters and opponents of the minimum wage assert that the issue is a matter of ethics and social justice involving worker exploitation and earning ability.[1] Supporters claim that increases in the minimum wage increase workers' earning power and protect workers against employer exploitation. Opponents claim that increases in the minimum wage increase unemployment; and the unemployment caused outweighs the benefits to minimum wage workers who remain employed, while allowing businesses to more effectively exploit the minimum wage workers who remain.

Contents |

Minimum wage law

Minimum wage laws vary greatly across many different jurisdictions, not only in setting a particular amount of money (e.g. US$6.55 per hour under U.S. Federal law, or £5.73 (for those aged 22+) in the United Kingdom), but also in terms of which pay period (e.g. Russia and China set monthly minimums) or the scope of coverage. Some jurisdictions allow employers to count tips given to their workers as credit towards the minimum wage level.

Economics of the minimum wage

Supply curve for labor

The number of hours of labor that workers are willing to supply is generally considered to be positively related to the real wage rate. Economists graph this relationship with the wage on the vertical axis and the quantity (hours) of labor supplied on the horizontal axis. Since higher wages increase the quantity supplied, the supply of labor curve is upward sloping, and is shown as a line moving up and to the right.

Demand curve for labor

A firm's cost is a function of the wage rate. The amount of labor demanded by firms is generally assumed to be negatively related to the real wage; as wages increase, firms demand less labor. This is because, as the wage rate rises, it becomes more expensive for firms to hire workers and so firms hire fewer workers (or hire them for fewer hours).

Effect of minimum wage on supply and demand

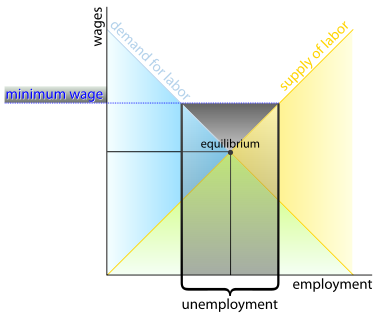

Combining the demand and supply curves for labor allows us to examine the effect of the minimum wage. We will start by assuming that the supply and demand curves for labor will not change as a result of raising the minimum wage. This may be an incorrect assumption since jobs this low on the demand curve may be so integral to a business' function that they will not simply disappear because the business has to pay more to hire people for those positions.

Standard theory criticism

Gary Fields, Professor of Labor Economics and Economics at Cornell University, argues that the standard "textbook model" for the minimum wage is "ambiguous", and that the standard theoretical arguments incorrectly measure only a one-sector market. Fields says a two-sector market, where "the self-employed, service workers, and farm workers are typically excluded from minimum-wage coverage… [and with] one sector with minimum-wage coverage and the other without it [and possible mobility between the two]," is the basis for better analysis. Through this model, Fields shows the typical theoretical argument to be ambiguous and says "the predictions derived from the textbook model definitely do not carry over to the two-sector case. Therefore, since a non-covered sector exists nearly everywhere, the predictions of the textbook model simply cannot be relied on."[4]

An alternate view of the labor market has low-wage labor markets characterized as monopsonistic competition wherein buyers (employers) have significantly more market power than do sellers (workers). This monopsony could be a result of intentional collusion between employers, or naturalistic factors such as segmented markets, information costs, imperfect mobility and the 'personal' element of labor markets. In such a case the diagram above would not yield the quantity of labor clearing and the wage rate. This is because while the upward sloping aggregate labor supply would remain unchanged, instead of using the downward labor demand curve shown in the diagram above, monopsonistic employers would use a steeper downward sloping curve corresponding to marginal expenditures to yield the intersection with the supply curve resulting in a wage rate lower than would be the case under competition. Also, the amount of labor sold would also be lower than the competitive optimal allocation.

Such a case is a type of market failure and results in workers being paid less than their marginal value. Under the monopsonistic assumption, an appropriately set minimum wage could increase both wages and employment, with the optimal level being equal to the marginal productivity of labor.[5] This view emphasizes the role of minimum wages as a market regulation policy akin to antitrust policies, as opposed to an illusory "free lunch" for low-wage workers. Conservative political commentator and economist Thomas Sowell argues that no collusion between employers to keep wages low has ever been demonstrated, asserting that in most labor markets, demand meets supply, and it is only minimum wage laws and other market interference which cause the imbalance.

Debate over consequences

The following table summarizes the arguments for and against minimum wage laws:

Supporters of the minimum wage claim it has these effects:

|

Opponents of the minimum wage claim it has these effects:

|

Criticism of minimum wages among economists

According to Linda Gorman, a senior fellow at the Independence Institute, a free-market think tank, there is a broad consensus among economists in opposition to minimum wage laws: "Most economists believe that minimum wage laws cause unnecessary hardship for the very people they are supposed to help."[26]

Princeton economist David F. Bradford writes, “The minimum wage law can be described as saying to the potential worker: ‘Unless you can find a job paying at least the minimum wage, you may not accept employment.’”[27]

MIT economist and Nobel laureate Paul A. Samuelson wrote in 1973, “What good does it do a black youth to know that an employer must pay him $2.00 per hour if the fact that he must be paid that amount is what keeps him from getting a job?”[28]

In a 1997 response to a request from the Irish National Minimum Wage Commission, economists for the Organization for Economic Cooperation and Development (OECD) summarized economic research results on the minimum wage: “If the wage floor set by statutory minimum wages is too high, this may have detrimental effects on employment, especially among young people.”[29]

This agreement over the general detrimental effect of minimum wages seems to be long-standing: According to a 1978 article in American Economic Review, 90 percent of the economists surveyed agreed that the minimum wage increases unemployment among low-skilled workers.[30]

However, the 2006 survey of American Economic Association members claims that there is no clear consensus about the minimum wage.[31] Andrew Jackson, the Chief Economist for the Canadian Labour Congress stresses that the economists working for the Organization for Economic Cooperation and Development (OECD) illustrate the continual need for adjustment of minimum wage levels and also show no consensus of opposition.[32]

Equivalence to a tax and subsidy

Gregory Mankiw, a former chairman of the Council of Economic Advisors, has argued that a minimum wage is equivalent to two conflicting policies:[33]

- A wage subsidy for unskilled workers, paid for by

- A tax on employers who hire unskilled workers.

The first part of the policy provides some benefit to low wage workers while the second part creates more unemployment among low wage workers. This is why the minimum wage is often criticized as a self-contradictory policy. However, other economists have argued that when the minimum wages is low, the small decrease in employment is more than offset by the increased benefit to workers.

Sociologist Lewis F. Abbott, has argued that employing companies are economic organizations, not charities or welfare agencies, and that national minimum wage fixing is a comparatively inefficient, costly, and dysfunctional method of raising the living standards of poorer households. It is much more practical and cost-effective for governments to seek to:

- maximize opportunities for work at whatever the going market rate for jobs (although virtually all full-time jobs pay more than the dole-money alternative, and even comparatively low-grade jobs offer valuable work experience and opportunities for advancement, etc.).

- top-up low wages with earned income tax credit or other direct cash subsidies if necessary; and

- save money in other areas -- e.g., cut purely social status-based welfare benefit payments to persons who do not require them, reduce monetary inflation, and remove various artificial political additions to basic living costs which necessitate income subsidies in the first place (e.g. regressive indirect taxes, tariffs on cheap food and clothing imports, and dear housing policies).[34]

Empirical studies

A classical economics analysis of supply and demand implies that by mandating a price floor above the equilibrium wage, minimum wage laws should cause unemployment. This is because a greater number of workers are willing to work at the higher wage while a smaller numbers of jobs will be available at the higher wage. Companies can be more selective in those whom they employ thus the least skilled and inexperienced will typically be excluded.

However, there are many other variables that can complicate the issue such as monopsony in the labour market, whereby the individual employer has some market power in determining wages paid. Thus it is at least theoretically possible that the minimum wage may boost employment. Though single employer market power is unlikely to exist in most labour markets in the sense of the traditional 'company town,' asymmetric information, imperfect mobility, and the 'personal' element of the labour transaction give some degree of wage-setting power to most firms.

Economists disagree as to the measurable impact of minimum wages in the 'real world'. This disagreement usually takes the form of competing empirical tests of the elasticities of demand and supply in labor markets and the degree to which markets differ from the efficiency that models of perfect competition predict.

A 2000 survey by Dan Fuller and Doris Geide-Stevenson reports that of a sample of 308 American Economic Association economists, 45.6% fully agreed with the statement, "a minimum wage increases unemployment among young and unskilled workers", 27.9% agreed with provisos, and 26.5% disagreed. The authors of this study also reweighted data from a 1990 sample to show that at that time 62.4% of academic economists agreed with the statement above, while 19.5% agreed with provisos and 17.5% disagreed.[37]

A similar survey in 2006 by Robert Whaples polled PhD members of the American Economic Association. Whaples found that 37.7% of respondants supported an increase in the minimum wage while 46.8% wanted it completely eliminated.[38]

In the debate about minimum wage it is rarely mentioned by how much the quantity of labor demanded may fall if the minimum wage is raised. Research papers by the Employment Policies Institute[39] and by the National Center for Policy Analysis[40] claim that increases of 10% in the minimum wage may reduce demand hours worked at the minimum wage by around 1% or 2% depending on circumstances.

Some research suggests that the unemployment effects of small minimum wage increases are dominated by other factors. [7] In Florida, where voters approved an increase in 2004, a follow-up comprehensive study confirms a strong economy with increased employment above previous years in Florida and better than in the U.S. as a whole. : “The Florida Minimum Wage After One Year.” http://www.risep-fiu.org/reports/Florida_Minimum_Wage_Report.pdf

According to a claim by the Mackinac Center for Public Policy[41], the passage of the first Federal mandated minimum wage in the United States in 1938 led to an estimated 500,000 blacks losing their jobs via replacement by higher skilled and more educated white laborers. Milton Friedman, 1976 Nobel Prize winner in Economics, called the minimum wage one of the most "anti-negro laws" for what he saw as its adverse effect on black employment.[42]

Today, the International Labour Organization (ILO)[2] and the OECD[9] do not consider that the minimum wage can be directly linked to unemployment in countries which have suffered job losses. Although strongly opposed by both the business community and the Conservative Party when introduced in 1999, the minimum wage introduced in the UK is no longer controversial and the Conservatives reversed their opposition in 2000.[43] A review of its effects found no discernible impact on pay levels.[44]

| Analysis | Source | Comparison | Prop. Effects on Wage | Prop Effects on Employment |

|---|---|---|---|---|

| New Jersey vs. Pennsylvania | New Jersey MW Increased to $5.05 April 1992 | Fast Food Joints Across States | 0.11* | 0.04 |

| Texas Fast Food Joints | FED MW increased to $4.25 April 1991 | High- and Low-Wage Restaurants | 0.08* | 0.2* |

| California Teenagers | California MW increase to $4.25 July 1988 | Teenagers in California | 0.1* | 0.12 |

| Teenagers Across States | Fed MW increase to $4.25 1989 - 92 | Cross States | 0.08* | 0.00 |

| Low Wage Workers Across States | FED MW increase to $4.25 | Across States | 0.07* | 0.02 |

MW - Minimum Wage FED - Federal

- indicates significance at 5%

Card and Krueger

The laws of demand and supply predict that an increase in the minimum wage will reduce employment.

In 1992, the Minimum wage in New Jersey increased by 18% while the adjacent state of Pennsylvania remained at $4.25. Card & Krueger gathered information on fast food restaurants that lay very close to the borders of Pennsylvania and New Jersey in an attempt to see what this effect had on employment within New Jersey. Classical economic would have concluded that relative employment should have decreased in New Jersey. Card and Krueger asked employers whether they intended to lay off workers in response to the increased minimum wage. Based on the employers' responses, the authors concluded that the increase in the minimum wage had no significant impact on employers' intentions to lay off employees.

The more common debate is on changes to minimum wages. This unified view was challenged by research done by David Card and Alan Krueger. In their 1997 book Myth and Measurement: The New Economics of the Minimum Wage (ISBN 0-691-04823-1), they argued the negative employment effects of minimum wage laws to be minimal if not non-existent (at least for the United States). For example, they look at the 1992 increase in New Jersey's minimum wage, the 1988 rise in California's minimum wage, and the 1990-91 increases in the federal minimum wage. They assume that the demand for low-wage workers is inelastic. Noteworthy is that these results do not refute the theory underlying the prediction that a minimum wage reduces employment. Rather, the results suggest that the effect predicted by the theory may, in some instances, be small enough as to be statistically zero.

Critics, however, argue that their research was flawed.[45] For example, Card and Krueger gathered their data by telephoning employers in Pennsylvania and New Jersey, asking them whether they intended to increase, decrease, or make no change in their employment. Subsequent attempts to verify the claims requested payroll cards from employers to verify employment, and found that the minimum wage increases were followed by decreases in employment. On the other hand, an assessment of data collected and analyzed by David Neumark and William Wascher did not initially contradict the Card/Krueger results,[46] but in a later edited version they found that the same general sample set did increase unemployment. The 18.8% wage hike resulted in "[statistically] insignificant—although almost always negative" employment effects.[47]

Another possible explanation for why the current minimum wage laws may not affect unemployment in the United States is that the minimum wage is set close to the equilibrium point for low and unskilled workers. Thus absent the minimum wage law unskilled workers would be paid approximately the same amount. However, an increase above this equilibrium point could likely bring about increased unemployment for the low and unskilled workers.

Reaction to Card and Krueger

Since the introduction of a national minimum wage in the UK in 1999, its effects on employment were subject to extensive research and observation by the Low Pay Commission. The Low Pay Commission found that, rather than make employees redundant, employers have reduced their rate of hiring, reduced staff hours, increased prices, and have found ways to cause current workers to be more productive (especially service companies).[48] Neither trade unions nor employer organizations contest the minimum wage, although the latter had especially done so heavily until 1999.

Some leading economists such as Greg Mankiw do not accept the Card/Krueger results,[49] while many leading economists like Paul Krugman[50] and Joseph Stiglitz do accept them,[51][52] In 1995, the Republican Staff of the Joint Economic Committee of the United States Congress published a study critical of Card and Krueger's work. They note that it conflicts with other studies done on minimum wage laws within the United States over the past 50 years.[53] According to the JEC analysis, minimum wage laws have been shown to cause large amounts of unemployment, especially among low-income, unskilled, black, and teenaged populations, as well as cause a host of other mal-effects, such as higher turnover, less training, and fewer fringe benefits.

According to economists Donald Deere (Texas A&M), Kevin Murphy (University of Chicago), and Finis Weltch (Texas A&M), Card and Krueger's conclusions are contradicted by "common sense and past research". They conclude that:[54]

| “ | Each of the four studies examines a different piece of the minimum wage/employment relationship. Three of them consider a single state, and two of them look at only a handful of firms in one industry. From these isolated findings Card and Krueger paint a big picture wherein increased minimum wages do not decrease, and may increase, employment. Our view is that there is something wrong with this picture. Artificial increases in the price of unskilled laborers inevitably lead to their reduced employment; the conventional wisdom remains intact. | ” |

Nobel laureate James M. Buchanan famously responded to the study in a Wall Street Journal editorial:

...no self-respecting economist would claim that increases in the minimum wage increase employment. Such a claim, if seriously advanced, becomes equivalent to a denial that there is even minimum scientific content in economics, and that, in consequence, economists can do nothing but write as advocates for ideological interests. Fortunately, only a handful of economists are willing to throw over the teaching of two centuries; we have not yet become a bevy of camp-following whores.

Paul Krugman, however, states that Card and Krueger "found no evidence that minimum wage increases in the range that the United States has experiences led to job losses. Their work has been furiously attacked both because it seems to contradict Econ 101 and because it was ideologically disturbing to many. Yet it has stood up very well to repeated challenges, and new cases confirming its results keep coming in."[55]

Alternatives to minimum wage

Negative income tax

Some critics of the minimum wage argue that a negative income tax or earned income tax credit would work better than a minimum wage, as it would benefit a broader population of low wage earners, not cause any unemployment, and distribute the cost widely rather than concentrating it on employers of low wage workers. A negative income tax or earned income tax credit based on a broad tax base would also be more economically efficient, as the minimum wage imposes a high marginal tax on employers, causing high deadweight loss. The ability of the earned income tax credit to deliver a larger monetary benefit to poor workers at a lower cost to society was recently documented in a report by the Congressional Budget Office.[56]

Basic income

Some economists and others have proposed as an alternative to a minimum wage, a so called Basic income, a system of social security, that periodically provides each citizen with a sum of money that is sufficient to live on. Except for citizenship, a basic income is entirely unconditional. Furthermore, there is no means test; the richest as well as the poorest citizens would receive it.

One of the main arguments for an basic income was articulated by the French Economist and Philosopher André Gorz: "The connection between more and better has been broken; our needs for many products and services are already more than adequately met, and many of our as-yet- unsatisfied needs will be met not by producing more, but by producing differently, producing other things, or even producing less. This is especially true as regards our needs for air, water, space, silence, beauty, time and human contact...

"From the point where it takes only 1,000 hours per year or 20,000 to 30,000 hours per lifetime to create an amount of wealth equal to or greater than the amount we create at the present time in 1,600 hours per year or 40,000 to 50,000 hours in a working life, we must all be able to obtain a real income equal to or higher than our current salaries in exchange for a greatly reduced quantity of work...

"Neither is it true any longer that the more each individual works, the better off everyone will be. The present crisis has stimulated technological change of an unprecedented scale and speed: `the micro chip revolution'. The object and indeed the effect of this revolution has been to make rapidly increasing savings in labour, in the industrial, administrative and service sectors. Increasing production is secured in these sectors by decreasing amounts of labour. As a result, the social process of production no longer needs everyone to work in it on a full-time basis. The work ethic ceases to be viable in such a situation and workbased society is thrown into crisis". André Gorz, Critique of Economic Reason, Gallilé,1989

A basic income is often proposed in the form of a citizen's dividend (a transfer) or (a guarantee). A basic income less than the social minimum is referred to as a partial basic income. A worldwide basic income, typically including income redistribution between nations, is known as a global basic income.

The proposal is a specific form of guaranteed minimum income, which is normally conditional and subject to a means test

In 1968 James Tobin, Paul Samuelson, John Kenneth Galbraith and another 1,200 economists in signed a document calling for the US Congress to introduce in that year a system of income guarantees and supplements. In the 1972 presidential campaign, Senator George McGovern called for a 'demogrant' that was very similar to a basic income.

Mike Gravel, a former candidate for the Democratic nomination for President of the United States and a candidate for the 2008 Libertarian nomination for the President of the United States, advocates for a tax rebate paid in a monthly check from the government to all citizens.

Winners of the Nobel Prize in Economics that fully support a basic income include Herbert Simon, Friedrich Hayek,[57] James Meade, Robert Solow, Milton Friedman,[58] Jan Tinbergen and James Tobin.

In later years, Basic Income Studies: How it could be organised, Different Sugestionshave made a lot serious, fully financed proposals for a basic income.

collective Bargaining

Sweden is an example of an developed nation where there is no minimum wage that is required by legislation. Instead, minimum wage standards in different sectors are set by collective bargaining.

See also

|

|

References

- ↑ 1.0 1.1 American Academy of Political and Social Science. "The Cost of Living." Philadelphia, 1913.

- ↑ 2.0 2.1 ILO 2006: Minimum wages policy (PDF)

- ↑ Fowler, T.A. and A.E. Smith, 2007. EPI minimum wage survey of economists. Employment Policies Institute, July.

- ↑ Gary Fields. "The Unemployment Effects of Minimum Wages". International Journal of Manpower. Retrieved on 2007-02-12.

- ↑ Manning, Alan (2003). Monopsony in motion: Imperfect Competition in Labor Markets. Princeton, NJ: Princeton University Press. ISBN 0691113122.

- ↑ 6.0 6.1 6.2 Minimum Wage and Its Effects on Small Business

- ↑ 7.0 7.1 7.2 7.3 http://www.epi.org/content.cfm/issueguides_minwage Real Value of the Minimum Wage

- ↑ 8.0 8.1 8.2 Richard B. Freeman. "Minimum Wages – Again!". International Journal of Manpower. Retrieved on 2007-02-12.

- ↑ 9.0 9.1 OECD (2006): OECD Employment Outlook 2006 (read-only PDF)

- ↑ Abbott, Lewis F. Statutory Minimum Wage Controls: A Critical Review of their Effects on Labour Markets, Employment, and Incomes. ISR Publications, Manchester UK, 2nd. edn. 2000. ISBN 978-0-906321-22-5. [1]

- ↑ Wal-Mart Warms to the State - Mises Institute

- ↑ Wal-Mart's Perverse Strategy on the Minimum Wage

- ↑ Tupy, Marian L. Minimum Interference, National Review Online, May 14, 2004

- ↑ "The Wages of Politics", Wall Street Journal.

- ↑ Offshoring High-Tech and Professional Jobs

- ↑ Increasing the Mandated Minimum Wage: Who Pays the Price?

- ↑ Why Wal-Mart Matters - Mises Institute

- ↑ Aaronson, D. and E. French, 2006. Output Prices and the Minimum Wage. Employment Policies Institute.

- ↑ 19.0 19.1 19.2 19.3 A blunt instrument, The Economist, October 26, 2006 (English)

- ↑ (Cato)

- ↑ Williams, Walter (1989). South Africa's War Against Capitalism. New York: Praeger. ISBN 027593179X.

- ↑ Keiner, Morris; Kudrle, Robert (2000). "Does Regulation Affect Economic Outcomes? The Case of Dentistry". Journal of Law and Economics 43: 548–582. doi:.

- ↑ Wilson, Lilla (1989-11-17). "How About a Real Minimum Wage Increase?", New York Times. Retrieved on 2008-02-24.

- ↑ (Cato)

- ↑ [2][3][4]

- ↑ http://www.econlib.org/library/Enc/MinimumWages.html

- ↑ “Minimum Wage vs. Supply and Demand,” Wall Street Journal, April 24, 1996.

- ↑ Paul Samuelson, Economics, 9th ed. (New York: McGraw-Hill, 1973), pp. 393–394.

- ↑ Organization for Economic Cooperation and Development, OECD Submission to the Irish National Minimum Wage Commission, Labour Market and Social Policy Occasional Papers no. 28, 1997, p. 15.

- ↑ Kearl, J. R., et al., “A Confusion of Economists?” American Economic Review 69 (1979): 28–37.

- ↑ Whaples, Robert (2006), "Do Economists Agree on Anything? Yes!,", The Economists' Voice: Vol. 3 : Iss. 9, Article 1.

- ↑ Jackson, Andrew, "The Economics of the Minimum Wage", http://canadianlabour.ca/sites/clc/files/01-29-07-The_Economics_of_the_Minimum_Wage.pdf

- ↑ Greg Mankiw's Blog: Working at Cross Purposes

- ↑ "The Effects of Minimum Wage Controls on Incomes and Welfare", in Abbott, Lewis F. Statutory Minimum Wage Controls: A Critical Review of their Effects on Labour Markets, Employment, and Incomes. Industrial Systems Research Publications, Manchester UK, 2nd. edn. 2000. ISBN 978-0-906321-22-5.

- ↑ Statistical Abstract of the United States, Bureau of Labor Statistics [5]

- ↑ U.S. Department of Labor, Employment Standards Administration [6]

- ↑ Fuller, Dan; Geide-Stevenson, Doris (2003). "Consensus Among Economists: Revisited" (PDF). Journal of Economic Review 34 (4): 369–387. http://www.indiana.edu/~econed/pdffiles/fall03/fuller.pdf.

- ↑ Robert Whaples (2006) "Do Economists Agree on Anything? Yes!," The Economists' Voice: Vol. 3 : Iss. 9, Article 1.

- ↑ "The Effect of Minimum Wage Increases on Retail and Small Business Employment", Employment Policies Institute (May 2006).

- ↑ "Minimum Wage Teen-age Job Killer", NATIONAL CENTER FOR POLICY ANALYSIS (May 20 1999).

- ↑ "Great Myths of the Great Depression (page 10)" (PDF), Mackinac Center for Public Policy (April 22, 2006).

- ↑ http://video.google.com/videoplay?docid=6813529239937418232&q=label%3Afree+market Milton Friedman Exposes The "Unholy Coalition" of Minimum Wage Supporters

- ↑ "National Minimum Wage". politics.co.uk. Retrieved on 2007-12-29.

- ↑ Metcalf, David (April 2007). "Why Has the British National Minimum Wage Had Little or No Impact on Employment?".

- ↑ "Myth and Measurement: The New Economics of the Minimum Wage", Cato Institute (April 22, 2006).

- ↑ http://www.epinet.org/briefingpapers/minimumw_bp_1996.pdf

- ↑ Neumark & Wascher, American Economic Review, Volume 90 No. 5.

- ↑ Low Pay Commission (2005). National Minimum Wage - Low Pay Commission Report 2005

- ↑ Greg Mankiw. Krugman on the Minimum Wage

- ↑ Paul Krugman, The conscience of a liberal (W.W. Norton & Co., 2007)

- ↑ Joseph Stiglitz. Employment, social justice and societal well-being, International Labour Review, 141 (1-2), p. 9 - 29.

- ↑ Economic Policy Institute. Hundreds of Leading Economists Say: Raise the Minimum Wage

- ↑ U.S. Congress Joint Economic Committee "50 Years of Research on the Minimum Wage"

- ↑ Sense and Nonsense on the Minimum Wage

- ↑ Paul Krugman, The conscience of a liberal, p. 261

- ↑ "Consequences of an increase in the minimum wage and expansions in the earned income tax credit." (PDF). Congressional Budget Office. Retrieved on 2008-07-25.

- ↑ Hayek, Friedrich (1973). Law, Legislation and Liberty: A New Statement of the Liberal Principles of Justice and Political Economy. 2. Routledge. pp. 87. ISBN 071008403X.

- ↑ Friedman, Milton; Rose Friedman (1990). Free to Choose: A Personal Statement. Harcourt. pp. 120–3. ISBN 0-15-633460-7.

External links

- Characteristics of Minimum Wage Workers: 2005 U.S. Department of Labor Bureau of Labor Statistics

- Minimum Wage Issue Guide by the Economic Policy Institute

- Basic Income Earth Network (BIEN)

- Basic income for all-Philippe van Parijs, Boston Review

- Guaranteed Basic Income Studies:How it could be organised, Different Sugesstions

- Basic Income Studies: An International Journal of Basic Income Research

- "Social minimum" in the Stanford Encyclopedia of Philosophy

- EIROnline: Minimum wages in Europe

- Low Pay Commission in the United Kingdom

- UK Department of Trade and Industry - The National Minimum Wage

- U.S. Department of Labor statistics

- The Minimum Wage: Information, Opinion, Research

- Average U.S. farm and non-farm wages compared to the minimum wage (1981 - 2004)

- Impact of Proposed Minimum-Wage Increase on Low-income Families (PDF) Center for Economic and Policy Research (December 2005)

- Center for Policy Alternatives – Minimum Wage Policy Model

- Find It! By Topic: Wages: Minimum Wage U.S. Department of Labor

- Wagenet - Australian Working Conditions

- Economist Paul Krugman on Minimum Wage Regulation

- Economist Philip Lewis - Centre for Labour Market Research - on the relationship between unemployment and minimum wages

- Minimum Wage Research, Studies and Resources by The Heritage Foundation

- Additional resources on the U.S. minimum wage and 2006 ballot initiatives at the Brennan Center for Justice at NYU School of Law

- Retiring Comfortably at Minimum Wage

- Fighting For a Minimum Wage - The Indypendent, Clark Merrefield

- Measuring the Full Impact of Minimum and Living Wage Laws from Dollars & Sense magazine

|

|||||||||||||||||||||||