Future value

Future value measures the nominal future sum of money that a given sum of money is "worth" at a specified time in the future assuming a certain interest rate, or more generally, rate of return; it is the present value multiplied by the accumulation function.

The value does not include corrections for inflation or other factors that affect the true value of money in the future. This is used in time value of money calculations.

Contents |

Simple interest

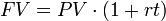

To determine future value (FV) using simple interest (i.e., without compounding):

where PV is the present value or principal, t is the time in years, and r stands for the per annum interest rate. Simple interest is rarely used, as compounding is considered more meaningful.

Compound interest

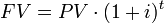

To determine future value using compound interest:

where PV is the present value, t is the number of compounding periods (not necessarily an integer), and i is the interest rate for that period.[1] Thus the future value increases exponentially with time. The growth rate is given by the period, and i , the interest rate for that period. Alternatively the growth rate is expressed by the interest per unit time based on continuous compounding. For example, the following all represent the same growth rate:

- 3% per half year

- 6.09 % per year (effective annual rate, annual rate of return, the standard way of expressing the growth rate, for easy comparisons)

- 2.95588022 % per half year based on continuous compounding (because ln 1.03 = 0.0295588022)

- 5.91176045 % per year based on continuous compounding (simply twice the previous percentage)

Also the growth rate may be expressed in a percentage per period (nominal rate), with another period as compounding basis; for the same growth rate we have:

- 6% per year with half a year as compounding basis

To convert an interest rate from one compounding basis to another compounding basis (between different periodic interest rates), the following formula applies:

where i1 is the periodic interest rate with compounding frequency n1 and i2 is the periodic interest rate with compounding frequency n2.

If the compounding frequency is annual, n will be 1, and to get the annual interest rate (which may be referred to as the effective interest rate, or the Annual percentage rate), the formula can be simplified to:

where r is the annual rate, i the periodic rate, and n the number of compounding periods per year.

Problems become more complex as you account for more variables. For example, when accounting for annuities (annual payments), there is no simple PV to plug into the equation. Either the PV must be calculated first, or a more complex annuity equation must be used. Another complication is when the interest rate is applied multiple times per period. For example, suppose the 10% interest rate in the earlier example is compounded twice a year (semi-annually). Compounding means that each successive application of the interest rate applies to all of the previously accumulated amount, so instead of getting 0.05 each 6 months, you have to figure out the true annual interest rate, which in this case would be 1.1025 (you divide the 10% by two to get 5%, then apply it twice: 1.052.) This 1.1025 represents the original amount 1.00 plus 0.05 in 6 months to make a total of 1.05, and get the same rate of interest on that 1.05 for the remaining 6 months of the year. The second six month period returns more than the first six months because the interest rate applies to the accumulated interest as well as the original amount.

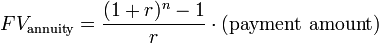

This formula gives the Future Value of an ordinary annuity (assuming compound interest):[2]

where r = interest rate; n = number of periods.

Implementations

The following is an implementation of the FV function in PHP, using compound interest and rounding to two decimal places:

<?php

function FV($p, $i, $t){ return round($p * pow(1+$i, $t), 2); }

?>

References

- ↑ "Calculating Future Value". Retrieved on 2008-07-10.

- ↑ "Future Value of an Ordinary Annuity". Retrieved on 2008-07-10.

See also

- Lifetime value

- Present value

- Time value of money

External links

- Disk Lectures free MBA level audio lecture with slideshow on future value and discounted cash flow.

- calculate the different FV's with your own values

![i_2=\left[\left(1+\frac{i_1}{n_1}\right)^\frac{n_1}{n_2}-1\right]{\times}n_2](/2009-wikipedia_en_wp1-0.7_2009-05/I/37e9e7d18f18c97d970cc60160a8cb4b.png)