Compound interest

Compound interest is the concept of adding accumulated interest back to the principal, so that interest is earned on interest from that moment on. The act of declaring interest to be principal is called compounding (i.e., interest is compounded). A loan, for example, may have its interest compounded every month: in this case, a loan with $1000 principal and 1% interest per month would have a balance of $1010 at the end of the first month.

Interest rates must be comparable in order to be useful, and in order to be comparable, the interest rate and the compounding frequency must be disclosed. Since most people think of rates as a yearly percentage, many governments require financial institutions to disclose a (notionally) comparable yearly interest rate on deposits or advances. Compound interest rates may be referred to as Annual Percentage Rate, Effective interest rate, Effective Annual Rate, and by other terms. When a fee is charged up front to obtain a loan, APR usually counts that cost as well as the compound interest in converting to the equivalent rate. These government requirements assist consumers to more easily compare the actual cost of borrowing.

Compound interest rates may be converted to allow for comparison: for any given interest rate and compounding frequency, an "equivalent" rate for a different compounding frequency exists.

Compound interest may be contrasted with simple interest, where interest is not added to the principal (there is no compounding). Compound interest predominates in finance and economics, and simple interest is used infrequently (although certain financial products may contain elements of simple interest).

Contents |

Terminology

The effect of compounding depends on the frequency with which interest is compounded and the periodic interest rate which is applied. Therefore, in order to define accurately the amount to be paid under a legal contract with interest, the frequency of compounding (yearly, half-yearly, quarterly, monthly, daily, etc.) and the interest rate must be specified. Different conventions may be used from country to country, but in finance and economics the following usages are common:

Periodic rate: the interest that is charged (and subsequently compounded) for each period. The periodic rate is used primarily for calculations, and is rarely used for comparison. The periodic rate is defined as the annual nominal rate divided by the number of compounding periods per year.

Nominal interest rate or nominal annual rate: the annual rate, unadjusted for compounding. For example, 12% annual nominal interest compounded monthly has a periodic (monthly) rate of 1%.

Effective annual rate: the nominal annual rate "adjusted" to allow comparisons; the nominal rate is restated to reflect the effective rate as if annual compounding were applied.

Economists generally prefer to use effective annual rates to allow for comparability. In finance and commerce, the nominal annual rate may be the most frequently used. When quoted with the compounding frequency, a loan with a given nominal annual rate is fully specified (the effect of interest for a given loan scenario can be precisely determined), but cannot be compared to loans with different compounding frequency.

Loans and finance may have other "non-interest" charges, and the terms above do not attempt to capture these differences. Other terms such as annual percentage rate and annual percentage yield may have specific legal definitions and may or may not be comparable, depending on the jurisdiction.

The use of the terms above (and other similar terms) may be inconsistent, and vary according to local custom, marketing demands, simplicity or for other reasons.

Exceptions

- US and Canadian T-Bills (short term Government debt) have a different convention. Their interest is calculated as (100-P)/P where 'P' is the price paid. Instead of normalizing it to a year, the interest is prorated by the number of days 't': (365/t)*100. (See day count convention).

- Corporate Bonds are most frequently payable twice yearly. The amount of interest paid (each six months) is the disclosed interest rate divided by two (multiplied by the principal). The yearly compounded rate is higher than the disclosed rate.

- Canadian mortgage loans are generally semi-annual compounding with monthly (or more frequent) payments.[1]

- U.S. mortgages generally use monthly compounding (with corresponding payment periods).

- Certain techniques for, e.g., valuation of derivatives may use continuous compounding, which is the limit as the compounding period approaches zero. Continuous compounding in pricing these instruments is a natural consequence of Ito Calculus, where derivatives are valued at ever increasing frequency, until the limit is approached and the derivative is valued in continuous time.

Mathematics of interest rates

Simplified calculation

Formulae are presented in greater detail at time value of money.

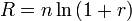

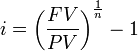

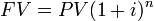

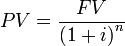

In the formula below, i or r are the interest rate, expressed as a true percentage (i.e. 10% = 10/100 = 0.10). FV and PV represent the future and present value of a sum. n represents the number of periods.

These are the most basic formulae:

The above calculates the future value of FV of an investment's present value of PV accruing at a fixed interest rate of i for n periods.

The above calculates what present value of PV would be needed to produce a certain future value of FV if interest of i accrues for n periods.

![i = \sqrt[n]{\left( \frac {FV} {PV} \right)} -1 \,](/2009-wikipedia_en_wp1-0.7_2009-05/I/36b79c738b8ba926854c017a0544c239.png)

- or

The above two formulae are the same and calculate the compound interest rate achieved if an initial investment of PV returns a value of FV after n accrual periods.

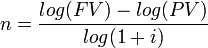

The above formula calculates the number of periods required to get FV given the PV and the interest rate i. The log function can be in any base, e.g. natural log (ln)

Compound

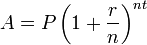

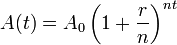

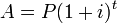

Formula for calculating compound interest:

Where,

- P = principal amount (initial investment)

- r = annual nominal interest rate (as a decimal)

- n = number of times the interest is compounded per year

- t = number of years

- A = amount after time t

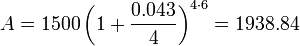

Example usage: An amount of $1,500.00 is deposited in a bank paying an annual interest rate of 4.3%, compounded quarterly. Find the balance after 6 years.

A. Using the formula above, with P = 1500, r = 4.3/100 = 0.043, n = 4, and t = 6:

So, the balance after 6 years is approximately $1,938.84.

Translating different compounding periods

Each time unpaid interest is compounded and added to the principal, the resulting principal is grossed up to equal P(1+i%).

A) You are told the interest rate is 8% per year, compounded quarterly. What is the equivalent effective annual rate?

The 8% is a nominal rate. It implies an effective quarterly interest rate of 8%/4 = 2%. Start with $100. At the end of one year it will have accumulated to:

$100 (1+ .02) (1+ .02) (1+ .02) (1+ .02) = $108.24

We know that $100 invested at 8.24% will give you $108.24 at year end. So the equivalent rate is 8.24%. Using a financial calculator or a tableis simpler still. Using the Future Value of a currency function, input

- PV = 100

- n = 4

- i = .02

- solve for FV = 108.24

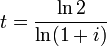

B) You know the equivalent annual interest rate is 4%, but it will be compounded quarterly. You need to find the interest rate that will be applied each quarter.

$100 (1+ .009853) (1+ .009853) (1+ .009853) (1+ .009853) = $104

The mathematics to find the 0.9853% is discussed at Time value of money, but using a financial calculator or table is easier. Input

- PV = 100

- n = 4

- FV = 104

- solve for interest = 0.9853%

C) You sold your house for a 60% profit. What was the annual return? You owned the house for 4 years, paid $100,000 originally, and sold it for $160,000.

$100,000 (1+ .1247) (1+ .1247) (1+ .1247) (1+ .1247) = $160,000

Find the 12.47% annual rate the same way as B.) above, using a financial calculator or table. Input

- PV = 100,000

- n = 4

- FV = 160,000

- solve for interest = 12.47%

Example question:

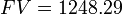

In January 1970 the S&P 500 index stood at 92.06 and in January 2006 the index stood at 1248.29. What has been the annual rate of return achieved? (ignoring dividends).

Answer:

Doubling

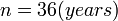

The number of time periods it takes for an investment to double in value is

where  is the interest rate as a fraction.

is the interest rate as a fraction.

Let p be the interest rate as a percentage ( i.e., 100 i ). Then the product of p and the doubling time t is fairly constant:

| interest | doubling time | product |

|---|---|---|

| -40 % | -1.3569 | 54.28 |

| -37 % | -1.5002 | 55.51 |

| -34 % | -1.6682 | 56.72 |

| -31 % | -1.868 | 57.91 |

| -28 % | -2.11 | 59.08 |

| -25 % | -2.4094 | 60.24 |

| -22 % | -2.7898 | 61.37 |

| -19 % | -3.2894 | 62.5 |

| -16 % | -3.9755 | 63.61 |

| -13 % | -4.9773 | 64.7 |

| -10 % | -6.5788 | 65.79 |

| -7 % | -9.5513 | 66.86 |

| -4 % | -16.9797 | 67.92 |

| -1 % | -68.9676 | 68.97 |

| -.1 % | -692.8005 | 69.28 |

| -.01 % | -6931.1252 | 69.31 |

| -.001 % | -69314.3715 | 69.31 |

| 1e-7 % | 693147123.555 | 69.31 |

| 1e-6 % | 69314718.8238 | 69.31 |

| 1e-5 % | 6931472.1481 | 69.31 |

| 1e-4 % | 693147.5272 | 69.31 |

| .001 % | 69315.0646 | 69.32 |

| .01 % | 6931.8184 | 69.32 |

| .1 % | 693.4937 | 69.35 |

| 1 % | 69.6607 | 69.66 |

| 2 % | 35.0028 | 70.01 |

| 5 % | 14.2067 | 71.03 |

| 8 % | 9.0065 | 72.05 |

| 11 % | 6.6419 | 73.06 |

| 14 % | 5.2901 | 74.06 |

| 17 % | 4.4148 | 75.05 |

| 20 % | 3.8018 | 76.04 |

| 23 % | 3.3483 | 77.01 |

| 26 % | 2.9992 | 77.98 |

| 29 % | 2.722 | 78.94 |

| 32 % | 2.4966 | 79.89 |

| 35 % | 2.3097 | 80.84 |

| 38 % | 2.1521 | 81.78 |

| 41 % | 2.0174 | 82.71 |

| 44 % | 1.9009 | 83.64 |

| 47 % | 1.7992 | 84.56 |

| 50 % | 1.7095 | 85.48 |

Thus for small interest rates such as daily ones the product is 69.3, for interest rates around 2% it is approximately 70, and for higher percentages one more for every 3%, until around 50%. then the increase of the product slows down somewhat. In the case of a negative rate a negative time for doubling means the absolute value of that time for halving. Again the product is approximately one less for every 3% less.

See also Rule of 72.

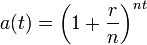

Periodic compounding

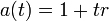

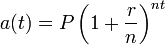

The amount function for compound interest is an exponential function in terms of time.

= Total time in years

= Total time in years

= Number of compounding periods per year (note that the total number of compounding periods is

= Number of compounding periods per year (note that the total number of compounding periods is  )

)

= Nominal annual interest rate expressed as a decimal. e.g.: 6% = 0.06

= Nominal annual interest rate expressed as a decimal. e.g.: 6% = 0.06

As  increases, the rate approaches an upper limit of

increases, the rate approaches an upper limit of  . This rate is called continuous compounding, see below.

. This rate is called continuous compounding, see below.

Since the principal A(0) is simply a coefficient, it is often dropped for simplicity, and the resulting accumulation function is used in interest theory instead. Accumulation functions for simple and compound interest are listed below:

Note: A(t) is the amount function and a(t) is the accumulation function.

Force of interest

|

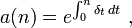

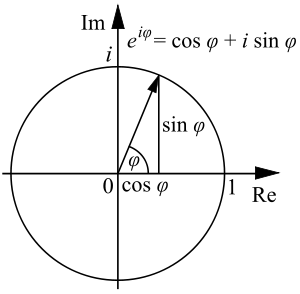

In mathematics, the accumulation functions are often expressed in terms of e, the base of the natural logarithm. This facilitates the use of calculus methods in manipulation of interest formulae.

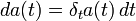

For any continuously differentiable accumulation function a(t) the force of interest, or more generally the logarithmic or continuously compounded return is a function of time defined as follows:

which is the rate of change with time of the natural logarithm of the accumulation function.

Conversely:

(since

(since  )

)

When the above formula is written in differential equation format, the force of interest is simply the coefficient of amount of change.

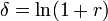

For compound interest with a constant annual interest rate r the force of interest is a constant, and the accumulation function of compounding interest in terms of force of interest is a simple power of e:

The force of interest is less than the annual effective interest rate, but more than the annual effective discount rate. It is the reciprocal of the e-folding time. See also notation of interest rates.

Continuous compounding

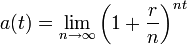

For interest compounded a certain number of times, n, per year, such as monthly or quarterly, the formula is:

Continuous compounding can be thought as making the compounding period infinitely small; therefore achieved by taking the limit of n to infinity. One should consult definitions of the exponential function for the mathematical proof of this limit.

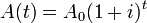

The amount function is simply

A common mnemonic device considers the equation in the form

called 'PERT' where P is the principal amount, e is the base of the natural log, R is the rate per period, and T is the time (in the same units as the rate's period), and A is the final amount.

With continuous compounding the rate expressed per year is simply 12 times the rate expressed per month, etc. It is also called force of interest, see the previous section.

The effective interest rate per year is

Using this i the amount function can be written as:

or

See also logarithmic or continuously compounded return.

Compounding bases

See Day count convention

To convert an interest rate from one compounding basis to another compounding basis, the following formula applies:

where r1 is the stated interest rate with compounding frequency n1 and r2 is the stated interest rate with compounding frequency n2.

When interest is continuously compounded:

where R is the interest rate on a continuous compounding basis and r is the stated interest rate with a compounding frequency n.

History

If the Native American tribe that accepted goods worth 60 guilders for the sale of Manhattan in 1626 had invested the money in a Dutch bank at 6.5% interest, compounded annually, then in 2005 their investment would be worth over €700 billion (around USD1 trillion), more than the assessed value of the real estate in all five boroughs of New York City. With a 6.0% interest however, the value of their investment today would have been €100 billion (7 times less!).

Compound interest was once regarded as the worst kind of usury, and was severely condemned by Roman law, as well as the common laws of many other countries. [2]

Richard Witt's book Arithmeticall Questions, published in 1613, was a landmark in the history of compound interest. It was wholly devoted to the subject (previously called anatocism), whereas previous writers had usually treated compound interest briefly in just one chapter in a mathematical textbook. Witt's book gave tables based on 10% (the then maximum rate of interest allowable on loans) and on other rates for different purposes, such as the valuation of property leases. Witt was a London mathematical practitioner and his book is notable for its clarity of expression, depth of insight and accuracy of calculation, with 124 worked examples.[3][4]

The Qur'an explicitly mentions compound interest as a great sin, even though Muslims all over the world continue using it. Interest known in Arabic as "riba" is considered wrong:

| “ | Oh you who believe, you shall not take riba, compounded over and over. Observe God, that you may succeed | ” |

See also

- Effective interest rate

- Nominal interest rate

- Exponential growth

- Rate of return on investment

- Credit card interest

- Fisher equation

- Yield curve

References

- ↑ http://laws.justice.gc.ca/en/showdoc/cs/I-15/bo-ga:s_6//en#anchorbo-ga:s_6 Interest Act (Canada), Department of Justice. The Interest Act specifies that interest is not recoverable unless the mortgage loan contains a statement showing the rate of interest chargeable, "calculated yearly or half-yearly, not in advance." In practice, banks use the half-yearly rate.

- ↑ This article incorporates content from the 1728 Cyclopaedia, a publication in the public domain.

- ↑ Lewin, C G (1970). "An Early Book on Compound Interest - Richard Witt's Arithmeticall Questions". Journal of the Institute of Actuaries 96 (1): 121–132.

- ↑ Lewin, C G (1981). "Compound Interest in the Seventeenth Century". Journal of the Institute of Actuaries 108 (3): 423–442.

![\sqrt[4]{1+.04}-1 = .00985341](/2009-wikipedia_en_wp1-0.7_2009-05/I/0b2d31c8885f746410c62c5106554faf.png)

![i = \sqrt[36]{\left( \frac {1248.29} {92.06} \right)} -1 = 7.51% \,](/2009-wikipedia_en_wp1-0.7_2009-05/I/f93a1686770c91a12c07afce83839094.png)

![r_2=\left[\left(1+\frac{r_1}{n_1}\right)^\frac{n_1}{n_2}-1\right]n_2](/2009-wikipedia_en_wp1-0.7_2009-05/I/fb2e90b9a753c4ba2ad03e302001e28d.png)