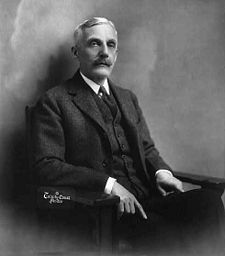

Andrew W. Mellon

|

Andrew William Mellon

|

|

|

|

|

49th United States Secretary of the Treasury

|

|

|---|---|

| In office March 4 1921 – February 12 1932 |

|

| Preceded by | David F. Houston |

| Succeeded by | Ogden L. Mills |

|

|

|

| Born | March 24, 1855 Pittsburgh, Pennsylvania, U.S. |

| Died | August 27, 1937 (aged 82) Southampton, New York, U.S. |

| Political party | Republican |

| Spouse | Nora McMullen Mellon |

| Alma mater | Western University of Pennsylvania |

| Profession | Banker, politician |

Andrew William Mellon (March 24 1855 — August 27 1937) was an American banker, industrialist, philanthropist, art collector and Secretary of the Treasury from March 4 1921 until February 12 1932.

Contents |

Early life

He was born in Pittsburgh, Pennsylvania, U.S., on March 24 1855, the son of Scots-Irish immigrants from County Tyrone Ireland. His father was Thomas Mellon, a banker and judge; his mother was Sarah Jane Negley Mellon. He was also brother of Richard B. Mellon. He was educated at the Western University of Pennsylvania (now the University of Pittsburgh), graduating in 1873.

Financial prodigy

Mellon demonstrated financial ability early in life by starting a lumber business at the age of 17. He joined his father's banking firm, T. Mellon & Sons, two years later and had ownership of the bank transferred to him in 1882. In 1889, Mellon helped organize the Union Trust Company and Union Savings Bank of Pittsburgh. He also branched into industrial activities: oil, steel, shipbuilding, and construction.

Three areas where Mellon's backing created giant enterprises were aluminum, industrial abrasives ("carborundum"), and coke. Mellon financed Charles Martin Hall, whose refinery grew into the Aluminum Company of America. He became the partner of Edward Goodrich Acheson in manufacturing silicon carbide; they founded the Carborundum Company. He created an entire industry through his help to Heinrich Koppers, inventor of coke ovens which transformed industrial waste into usable products such as coal-gas, coal-tar, and sulfur.

Mellon eventually became one of the four richest people in the United States alongside John D. Rockefeller and Henry Ford.[1]

Johnstown Flood

Mellon was a member of the South Fork Fishing and Hunting Club, whose earthen dam failed in May 1889 and caused the Johnstown Flood. Mellon was a member of the Duquesne Club. Along with his closest friend Henry Clay Frick and Philander Knox, also South Fork Fishing and Hunting Club members, Mellon served as a director of the Pittsburgh National Bank of Commerce.

Career

Fundraising

During World War I he participated in many fundraising activities such as the American Red Cross, the National War Council of the Y.M.C.A., the Executive Committee of the Pennsylvania State Council of National Defense, and the National Research Council of Washington.

Cabinet secretary

Andrew Mellon was appointed Secretary of the Treasury by new President Warren G. Harding in 1921. He served for ten years and eleven months; the third-longest tenure of a Secretary of the Treasury. His service continued through the Coolidge administration and most of the Hoover administration.

President Harding, in his inaugural address on March 4 1921, called for a prompt and thorough revision of the tax system, an emergency tariff act, readjustment of war taxes, and creation of a federal budget system. These were policies Mellon wholeheartedly subscribed to, and his long experience as a banker qualified him to set about implementing these programs immediately. As a conservative Republican and a financier, Mellon was irritated by the manner in which the government's budget was maintained, with expenses due now and rising rapidly, with income or revenues not keeping pace with those expense increases, and with the lack of savings.

The Mellon plan

Mellon came into office with a goal of reducing the huge federal debt from World War I. To do this, he needed to increase the federal revenue and cut spending. He believed that if the tax rates were too high, that the people would try to avoid paying them. He observed that as tax rates had increased during the first part of the 20th century, investors moved to avoid the highest rates—by choosing tax-free municipal bonds, for instance. As Mellon wrote in 1924:[2]

The history of taxation shows that taxes which are inherently excessive are not paid. The high rates inevitably put pressure upon the taxpayer to withdraw his capital from productive business.

If the rates were set more reasonably, taxpayers would have less incentive to avoid paying. His controversial theory was that by lowering the tax rates across the board, he could increase the overall tax revenue.

Andrew Mellon's plan had four main points:

- Cut the top income tax rate from 77 to 25 percent

- Cut taxes on low incomes

- Reduce the Federal Estate tax

- Efficiency in government

Mellon believed that the income tax should remain progressive, but with lower rates than those enacted during World War I. He thought that the top income earners would only willingly pay their taxes if rates were 25% or lower. Mellon proposed tax rate cuts, which Congress enacted in the Revenue Acts of 1921, 1924, and 1926. The top marginal tax rate was cut from 73% to 58% in 1922, 50% in 1923, 46% in 1924, 25% in 1925, and 24% in 1929. Rates in lower brackets were also cut substantially, relieving burdens on the middle-class, working-class, and poor households.

By 1926 65% of the income tax revenue came from incomes $300,000 and higher, when five years prior, less than 20% did. During this same period, the overall tax burden on those that earned less than $10,000 dropped from $155 million to $32.5 million.[3]

Mellon also championed preferential treatment for "earned" income relative to "unearned" income. As he argued in his 1924 book, Taxation: The People's Business:

The fairness of taxing more lightly income from wages, salaries or from investments is beyond question. In the first case, the income is uncertain and limited in duration; sickness or death destroys it and old age diminishes it; in the other, the source of income continues; the income may be disposed of during a man’s life and it descends to his heirs. Surely we can afford to make a distinction between the people whose only capital is their mettle and physical energy and the people whose income is derived from investments. Such a distinction would mean much to millions of American workers and would be an added inspiration to the man who must provide a competence during his few productive years to care for himself and his family when his earnings capacity is at an end.

Mellon's policy reduced the public debt (largely inherited from World War I obligations) from almost $26 billion in 1921 to about $16 billion in 1930, but then the Depression caused it to rise again. By 1935, Franklin Roosevelt had gone back to high tax rates and wiped out Andrew Mellon's initiatives. The top tax rate went to 80% by 1935 and the federal government increased excise taxes to make up for the lost revenue.[4]

The Great Depression

Mellon became unpopular with the onset of the Great Depression. Many economists today (such as Milton Friedman and Fed Chairman Ben Bernanke, to give two prominent examples) partially attribute the collapse of the American banking industry to the popularity among Federal Reserve leadership of Mellon's infamous "liquidationist" thesis: weeding out "weak" banks was seen as a harsh but necessary prerequisite to the recovery of the banking system. This "weeding out" was accomplished through refusing to lend cash to banks (taking loans and other investments as collateral), and by refusing to put more cash in circulation. He advocated spending cuts to keep the Federal budget balanced, and opposed measures for relief of public suffering. In 1929-31, he spent much of the time overseas, negotiating for repayment of European war debts from World War I. In February 1932, Mellon left the Treasury Department and accepted the post of U.S. Ambassador to the United Kingdom. He served for one year and then retired to private life.

Personal life

In 1900, Mellon, then 45 years old, married Nora Mary McMullen (1879-1973), a 20-year-old Irishwoman who was the daughter of Alexander P. McMullen, a major shareholder of the Guinness Brewing Co. They had two children, Ailsa, born in 1901, and Paul, born in 1907. Their marriage ended in a bitter divorce in 1912, which was granted on grounds of Nora Mellon's desertion and her adultery with Capt. George Alfred Curphey, an English soldier, and other men.

Mellon did not remarry, though in 1923, his former wife married Harvey Arthur Lee, a British-born antiques dealer 14 years her junior,.[5] Two years after the Lees' divorce in 1928, Nora Lee resumed the surname Mellon, at the request of her son, Paul.[6]

In 1913, along with his brother, Richard B. Mellon, he established a memorial to his father, the Mellon Institute of Industrial Research, today a part of Carnegie Mellon University

During his retirement years, as he had done in earlier years, Mellon was an active philanthropist, and gave generously of his private fortune to support art and research causes.

In 1937, he donated his substantial art collection, plus $10 million for construction, to establish the National Gallery of Art on the National Mall in Washington, D.C. The Gallery was authorized in 1937 by Congress.

The Mellon tax trial

The Roosevelt administration subjected Mellon to intense investigation of his personal income tax returns. The Justice Department empaneled a grand jury, which declined to issue an indictment. A two-year civil action beginning in 1935, dubbed the "Mellon Tax Trial," eventually exonerated Mellon, albeit several months after his death.

Death

Mellon died on August 27 1937, in Southampton, Long Island, New York. Buried at Trinity Episcopal Church Cemetery, Upperville Virginia

Legacy

The Andrew W. Mellon Foundation, the product of the merger of the Avalon Foundation and the Old Dominion Foundation (set up separately by his children), is named in his honor, as is the 378-foot U.S. Coast Guard Cutter Mellon.

Family

- Father: Thomas Alexander Mellon (b. 1813, d. 1908)

- Mother: Sarah Jane Negley (b. 1817, d. 1909)

- Brother: Richard B. Mellon (b. 1858, d. 1933)

- Wife: Nora McMullen (m. 1900, div., d. 1913)

- Daughter: Ailsa Mellon Bruce (b. 1901, d. 1969)

- Son: Paul Mellon (b. 1907, d. 1999)

Books

- Mellon, Andrew W., Taxation: The People's Business

References

- ↑ Cannadine, p. 585

- ↑ Mellon, Andrew W (1924). Taxation: The People's Business. New York: Macmillan. pp. 13. ISBN 978-0405051012.

- ↑ The Myth of the Robber Barons by Burton W. Folsom

- ↑ The Myth of the Robber Barons by Burton W. Folsom

- ↑ http://www.time.com/time/magazine/article/0,9171,881064,00.html

- ↑ http://www.time.com/time/magazine/article/0,9171,789247,00.html

- David Cannadine, Mellon: An American Life, Knopf, 2006, ISBN 0-679-45032-7

- Biography at the U.S. treasury department

- Burton W. Folsom, Jr. The Myth of the Robber Barons (A New Look at the Rise of Big Business in America)

See also

- Great Depression

- Mellonomics

External links

- The Andrew W. Mellon - Mellon Foundation Biography by David Cannadine

- The Andrew W. Mellon Foundation

- taxhistory.org - an essay on Mellon's tax policies

- Overview of Mellon Tax Cut Plans

- Pittsburgh Post-Gazette article on history of the Mellons and Mellon Financial

- Pittsburgh Post-Gazette series on Mellon's involvement in the oil industry and mid-east oil

| Political offices | ||

|---|---|---|

| Preceded by David F. Houston |

United States Secretary of the Treasury March 4, 1921 – February 12, 1932 |

Succeeded by Ogden L. Mills |

| Diplomatic posts | ||

| Preceded by Charles G. Dawes |

U.S. Ambassador to the United Kingdom 1932 – 1933 |

Succeeded by Robert Worth Bingham |

|

|||||||